Product Life Cycles Are Incredibly Short

There are almost no other industries in which a product has such a short life-cycle as in IT. Most industries have product life cycles that last years, even decades. Automotive model platforms, for example, go five years or more with only small annual tweaks. Blockbuster drugs can be marketed for over a decade with the only change being to price when the patent expires. Consumer products (e.g., Diet Coke, Oreos, Campbell’s Tomato Soup) last decades with only gradual changes that are carefully researched and market tested for years.

But in IT, last year’s generation has by this season been discontinued or priced way down to clear obsolete inventory. Products based on an important new capability in some component or factor are always being introduced, whether the new factor is in the CPU, graphics processor, display, hard drive, operating system, management software, device capacity, supporting apps, cloud service, business model, or another component. And because of this, product planning involves hitting the fast moving target. Product plans cannot be based on the state of the technology today, but on what it will be when the new device is introduced. And these decisions have to be made in an amazingly short time or the window of opportunity will be gone. Delay means failure.

Competitors Are Coming From Everywhere

In IT markets, the intensity of competition is unmatched. One of the reasons for this is the number of directions that competitors can come at you from. There are other large IT firms that are branching into your space, recent IPOs often flush with cash and sporting a booming user base, and venture-funded start-ups that might invalidate an entire technology. Indeed, the venture capital industry might be thought of as a giant, competition-generating machine with billions of dollars at its disposal to make life miserable for the established companies.

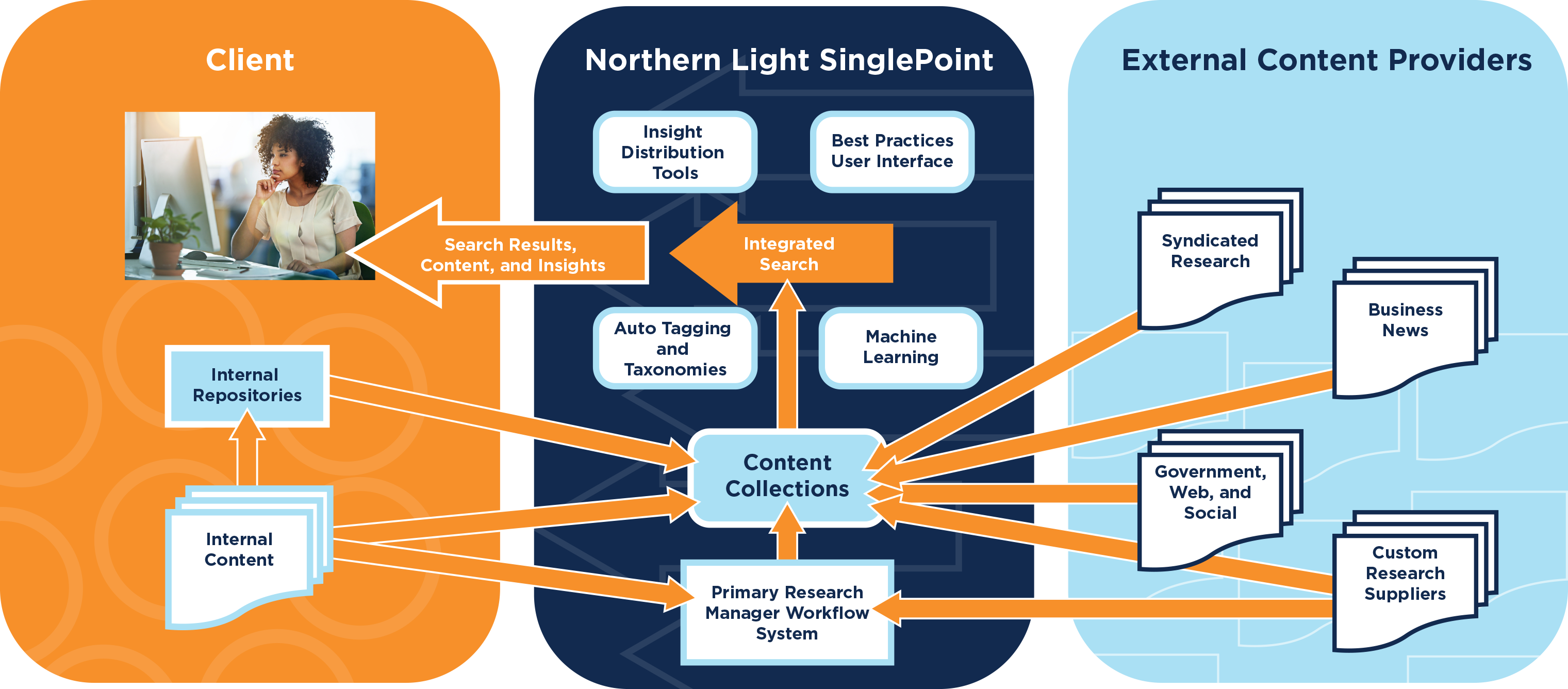

Advanced technology from Northern Light and strong team collaboration achieved ROI of millions of dollars annually. Using market and industry research via SinglePoint has become part of our employees average work day.”

Program Manager, Market Intelligence

Strategic Research Has To Be Performed In A Decentralized, Distributed Manner By Middle Level Managers

Because of the short product life-cycle and intense competitive environment, there is just not enough time for centralized decision making on a wide variety of product marketing strategies. Any centralized process implies a list of tasks to be accomplished by the centralized resource and a system for prioritizing those tasks. (Sometimes this priority-setting system is called “politics.”) In a rapidly-changing, intensely-competitive market like IT, any product or business that cannot get to the top of the priority list for a necessary, centrally-controlled resource is effectively dead.

So unlike pharmaceuticals, automotive, or consumer products, IT strategic research cannot be left to a centralized market intelligence staff. Rather it has to be distributed out to product managers, marketing managers, program managers, marketing communication managers, research managers, product development managers, sales managers, and to market intelligence personnel working in the business units and responsive to their time pressures.

There Are Third-party Analysts And Journalists With Significant Influence On Buying Decisions

Unique to the IT industry, the presence of third-party analysts – Forrester, IDC, Gartner, and scores of others – greatly impacts the marketing of products. While reviewers of products are present in many industries – Consumer Reports in consumer durables, for example – the IT analyst community goes far beyond merely writing the occasional review.

IT analysts rate products and companies, give talks at customer events, hold webinars and teleconferences, and respond personally to the product and vendor questions of large buyers. The IT analysts have privileged access to vendors’ product roadmaps because of their influence, and they condition buyers to expect and favor certain technical strategies over others. Big purchases of IT solutions will often involve direct customer consultation with one or more IT analysts. And the analysts are whisper central, using their industry contacts with buyers and sellers to concentrate all the industry chatter into one convenient one-stop shop for future product plans and technical strategies.

In addition, there are many active IT industry journalists and news publications that perform this same role with more immediate response times, if less influence in the long run.

Having everything available in one global market research collection produced productivity and financial gains that exceeded even our high expectations for the knowledge management system. But what we really discovered was how many business decisions and outcomes could be impacted with the right market research portal solution.That was the big win.”

Director of Market Research

There Is A Vast Amount Of It Industry Research From Many Diverse Sources

In some industries, the majority of the market research is created in a directed process by the company itself. For example, a consumer products company will conduct primary research on consumers to guide the product development plans. These firms may have a lot of research, but it is mostly what they generate themselves.

By contrast, there are literally hundreds of thousands of IT analyst reports from the top 80 firms published each year. The problems of harvesting this content and related content from these analysts have increased over the last decade. An IT analyst will have published reports available from his firm, but will also participate in the “IT Analyst Social Web” with a blog available as an identified URL, a Twitter account, and may moderate a LinkedIn group. He or she may be giving conference presentations which are posted to a slide sharing service like SlideShare. Tracking any one of the hundreds of IT analysts could easily involve integration of five sources. And lastly, just to make the problem harder, the analyst may be interviewed by trade journals and the business media and be providing quotes to the press on new developments.

In addition, there are hundreds of news sites dedicated to covering the IT industry. These trade sites are deep repositories of industry expertise. Lastly, there is extensive coverage of the IT industry in general business news sources such as Reuters.

Companies post a lot of competitively interesting information on their websites: Product specifications, customer case studies, financial press releases, and more. It may be useful to employ a directed web crawl to index and make searchable a long collection of competitors’ websites, embedding this functionality in the strategic research portal.

White papers are another source of market intelligence that is often very informative. Unique to the IT Industry, many companies publish at least a public version of their product roadmaps and technical strategies in the form of white papers. In these white papers the solutions vendors describe their technical vision, why they think their approach is advantageous over the technologies used by their competitors, and hint at their future directions.

Government databases can in some cases be useful for strategic research. For example, the SEC filings for a company may contain discussions of business strategy.

Another source of market intelligence is the sales force. An IT company’s sales force will often hear about competitive moves before anyone else. While this factor is not a big influence on things like new products, which are likely to be announced formally or rumored early by IT analyst and journalists, it can be a factor for marketing and sales campaigns and promotions.

Lastly, even in IT firms, not all strategic research originates with third parties. Significant market intelligence is generated by the market intelligence staffs in the business areas of an IT company. Often, this research is in the form of synthesis of the outside research. At a large IT firm, there may be hundreds or even thousands of market intelligence professionals, product managers, competitive intelligence analysts, key account team members, and marketing managers synthesizing strategic research and putting it into the company’s perspective. These syntheses can be invaluable to other employees.

Customers Buy And Read The Same Market Research That Information Technology Solution Vendors Buy And Read

One consequence of the presence of IT analysts is that, uniquely in the IT industry, buyers and sellers have access to the same strategic research about products. Because the buyers are using the research to make purchase decisions, the IT analyst reports become an integral part not only of planning product strategy, but also for building marketing campaigns and sales presentations. A marketing message that is at variance to the line being taken by the IT analyst community will carry far less weight or a sales presentation that does not include IT analyst commentary will be less impactful because the customer is reading these syndicated studies as well.

Implications For Knowledge Management

Given all of the above, the implications for knowledge management within the IT industry are profound. First of all, the “knowledge assets” of IT firms are not “things we know,” but rather “information sources we have available” and “processes, systems, and skills we have for learning things.” Anything you learn through research in the IT industry will be obsolete in a year at most, typically in a few months and sometimes just days after you learn it. The only really lasting thing to learn is how to learn. Knowledge management for strategic management in the IT industry is the process of institutionalizing a research-driven, learning culture. Therefore, knowledge management of strategic research inside an IT firm needs to have several characteristics:

- Enterprise-wide availability of external strategic research with as few restrictions as possible on access;

- Self-service environment for searching the content repositories and consuming strategic research;

- Collaborative research portal environment that encourages cross-functional and interdepartmental sharing of insights gleaned from the research;

- Comprehensive alerting across all sources;

- Options for publishing synthesized research to user groups (i.e., dashboards); and

- Options for using text analytics and trend analysis to help grasp the significance of a large number of relevant documents that a typical query returns.

In summary, knowledge management for IT industry strategic research requires connecting every relevant information source to all of the functional areas within an organization that uses research via a comprehensive array of options for information access, consumption, and sharing.